Federal Reserve Bank (FED)

Re-working this section.

Re-working this section.

Federal Reserve Seeks to Protect U.S. Bailout Secrets

|

|

| Federal Reserve Exposed, Corrupt Banking Families 1/2 [l=11:00] |

Federal Reserve Exposed, Corrupt Banking Families 2/2 [l=4:58] |

|

|

| The Fed Under Fire [l=7:59] | |

Banking Overview, Including the Role of the FED

I just found the first video. Skip over the introduction, since it is kind of corny, but the rest is good. I like Niall Ferguson video "Ascent of Money", because it steps you through the history of the banking industry. I like the video "Money Masters" because it goes through the history of banking in a no nonsense manner. And the "Secrete of Oz" re-enforces why the FED is so bad.

Federal Reserve Bank

Notice: the Wikipedia history of the creation of the Federal Reserve is quite a bit different from the videos description above. Who is telling the truth??

Federal Reserve: http://www.federalreserve.gov/OTHERFRB.HTM

From Wikipedia: http://en.wikipedia.org/wiki/Federal_reserve_bank

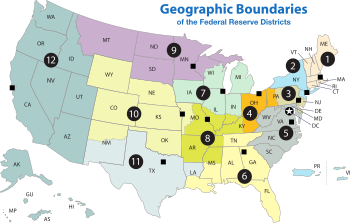

The twelve Federal Reserve Banks form a major part of the Federal Reserve System, the central banking system of the United States. The twelve federal reserve banks together divide the nation into twelve Federal Reserve Districts, the twelve banking districts created by the Federal Reserve Act of 1913.[1] The twelve Federal Reserve Banks are jointly responsible for implementing the monetary policy set by the Federal Open Market Committee. Each federal reserve bank is also responsible for the regulation of the commercial banks within its own particular district.

History

Alexander Hamilton, the first Secretary of Treasury, started a movement advocating the creation of a central bank.

In response to this, the First Bank of the United States was established in 1791, its charter signed by George Washington. The First Bank of the United States was headquartered in Philadelphia, but had branches in other major cities. The Bank performed the basic banking functions of accepting deposits, issuing bank notes, making loans and purchasing securities.

When its charter expired twenty years later, the US was without a central bank for a few years, during which it suffered an unusual inflation. In 1816, James Madison signed the Second Bank of the United States into existence.

When that bank's charter expired, the United States went without a central bank for forty years.

Then, in 1873, Congress nationalized money for the first time, imposing what was effectively a gold standard, in the place of the bimetallic standard set in place by the Founders. The Coinage Act of 1873 set off a cycle of growth and depression/panic that came to be known as the "business cycle".[citation needed] One such crisis, the Panic of 1907, was headed off by a private conglomerate, who set themselves up as "lenders of last resort" to banks in trouble.[citation needed] This effort succeeded in stopping the panic, and led to calls for a Federal agency to do the same thing.[citation needed]

Role in the history of the Federal Reserve

Jekyll Island was the location of a meeting in November 1910 in which draft legislation was written to create the U.S. Federal Reserve. Following the Panic of 1907, banking reform became a major issue in the United States. Senator Nelson Aldrich (R-RI), chairman of the National Monetary Commission, went to Europe for almost two years to study that continent's banking systems. Upon his return, he brought together many of the country's leading financiers to Jekyll Island to discuss monetary policy and the banking system, an event which was the impetus for the creation of the Federal Reserve.

On the evening of November 22, 1910, Sen. Aldrich and A.P. Andrews (Assistant Secretary of the Treasury Department), Paul Warburg (a naturalized German representing Kuhn, Loeb & Co.), Frank A. Vanderlip (president of the National City Bank of New York), Henry P. Davison (senior partner of J. P. Morgan Company), Charles D. Norton (president of the Morgan-dominated First National Bank of New York), and Benjamin Strong (representing J. P. Morgan), together representing about one fourth the world's wealth at the time, left Hoboken, New Jersey on a train in complete secrecy, dropping their last names in favor of first names, or code names, so no one would discover who they all were. The excuse for such powerful representatives and wealth was to go on duck hunting trip on Jekyll Island.

Forbes magazine founder Bertie Charles Forbes wrote several years later:

Picture a party of the nation’s greatest bankers stealing out of New York on a private railroad car under cover of darkness, stealthily riding hundreds of miles South, embarking on a mysterious launch, sneaking onto an island deserted by all but a few servants, living there a full week under such rigid secrecy that the names of not one of them was once mentioned, lest the servants learn the identity and disclose to the world this strangest, most secret expedition in the history of American finance. I am not romancing; I am giving to the world, for the first time, the real story of how the famous Aldrich currency report, the foundation of our new currency system, was written... The utmost secrecy was enjoined upon all. The public must not glean a hint of what was to be done. Senator Aldrich notified each one to go quietly into a private car of which the railroad had received orders to draw up on an unfrequented platform. Off the party set. New York’s ubiquitous reporters had been foiled... Nelson (Aldrich) had confided to Henry, Frank, Paul and Piatt that he was to keep them locked up at Jekyll Island, out of the rest of the world, until they had evolved and compiled a scientific currency system for the United States, the real birth of the present Federal Reserve System, the plan done on Jekyll Island in the conference with Paul, Frank and Henry... Warburg is the link that binds the Aldrich system and the present system together. He more than any one man has made the system possible as a working reality.[5]

In response to this, the Federal Reserve System was created by the Federal Reserve Act of 1913, establishing a new central bank intended serve as a formal "lender of last resort" to banks in times of liquidity crisis—panics where depositors tried to withdraw their money faster than a bank could pay it out.

The legislation provided for a system that included a number of regional Federal Reserve Banks and a seven-member governing board. All national banks were required to join the system and other banks could join. The Federal Reserve Banks opened for business in November 1914. Congress created Federal Reserve notes to provide the nation with an elastic supply of currency. The notes were to be issued to Federal Reserve Banks for subsequent transmittal to banking institutions in accordance with the needs of the public.

The twelve regional Federal Reserve Banks were established as the operating arms of the nation's central banking system. They are organized much like private corporations—possibly leading to some confusion about ownership.[citation needed]

Function

The Bank Bill created by Alexander Hamilton was a proposal to institute a National Bank, in order to improve the economic stability of the nation after its independence from Britain. Although the bank is used as a tool for the government, it is privately owned. Hamilton wrote several articles providing information regarding his national bank idea. The articles expressed the validity and "would be" success of the national bank based upon: incentives for the rich to invest, ownerships of bonds and shares, rooted in fiscal management, and stable monetary system. The National Bank, or Federal Reserve Banking System provides the government with a ready source of loans, it is also the safe depository for federal monies. The Federal Reserve is also a low cost mechanism for transferring funds and it is an inexpensive agent for meeting payments on the national debt and government salaries.

The Federal Reserve Banks issue shares of stock to member banks. However, owning Federal Reserve Bank stock is quite different from owning stock in a private company. The Federal Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the system. The stock may not be sold or traded or pledged as security for a loan; dividends are, by law, limited to 6 percent per year.[2]

The dividends paid to member banks are considered partial compensation for the lack of interest paid on member banks' required reserves held at the Federal Reserve. By law, banks in the United States must maintain fractional reserves, most of which are kept on account at the Federal Reserve. Historically, the Federal Reserve did not pay interest on these funds. The Federal Reserve now has authority to pay interest on these funds granted by Congress in the EESA of 2008.

The Federal Reserve Bank of New York is located only a few blocks from the former location of the World Trade Center buildings. It has a gold vault 100 feet (30 m) beneath the street. That depository is the largest in the world; even larger than the legendary Fort Knox gold reserves in the mid-1980s. The gold is owned by foreign nations, including Saudi Arabia and Kuwait. Its value is estimated at $25 billion. Free tours of the vault are available to the public.

A major responsibility of The Federal Reserve is to oversee their banking and financial systems. Overseeing the banking and financial systems of a bank is crucial in a society.[3]

Confidence in the soundness of the banking and financial systems is what mobilizes a societies savings, allows the savings to be channeled into productive investments, and encourages economic growth.

There is a lot of speculation and controversy over the issue of monetary control. By constitutional law the Bureau of Engraving and Printing (BEP, GOV) is the only entity allowed to manufacture, print, or mint US Monies. The Federal Reserve System is the only entity authorized by the US Government to legally destroy currency deemed unfit for circulation. All currency destroyed must be reported to the US Treasury so new monies can be produced by the Bureau of Engraving and Printing to replace that which has been destroyed. The only means in which the Federal Reserve System can create money is by offering banking institutions additional credit on the reserves held by the Federal Reserve System to those financial institutions in need of additional assistance. These “Loans†must be approved by the US Treasury, therefore leaving the monetary control under Government rulings. The Federal Reserve System operates under very strict guidelines set forth by the US Treasury, and is subjected to routine audits from government officials operating from the offices of the Treasury.

Banks

The Federal Reserve officially identifies Districts by number and Reserve Bank city.[4]

- 1st District (A) - Federal Reserve Bank of Boston [1]

- 2nd District (B) - Federal Reserve Bank of New York [2]

- 3rd District (C) - Federal Reserve Bank of Philadelphia [3]

- 4th District (D) - Federal Reserve Bank of Cleveland [4], with branches in Cincinnati, Ohio and Pittsburgh, Pennsylvania

- 5th District (E) - Federal Reserve Bank of Richmond [5], with branches in Baltimore, Maryland and Charlotte, North Carolina

- 6th District (F) - Federal Reserve Bank of Atlanta [6], with branches in Birmingham, Alabama; Jacksonville, Florida; Miami, Florida; Nashville, Tennessee; and New Orleans, Louisiana

- 7th District (G) - Federal Reserve Bank of Chicago [7], with a branch in Detroit, Michigan

- 8th District (H) - Federal Reserve Bank of St. Louis [8], with branches in Little Rock, Arkansas; Louisville, Kentucky; and Memphis, Tennessee

- 9th District (I) - Federal Reserve Bank of Minneapolis [9], with a branch in Helena, Montana

- 10th District (J) - Federal Reserve Bank of Kansas City [10], with branches in Denver, Colorado; Oklahoma City, Oklahoma; and Omaha, Nebraska

- 11th District (K) - Federal Reserve Bank of Dallas [11], with branches in El Paso, Texas; Houston, Texas; and San Antonio, Texas

- 12th District (L) - Federal Reserve Bank of San Francisco [12], with branches in Los Angeles, California; Portland, Oregon; Salt Lake City, Utah; and Seattle, Washington

The New York Federal Reserve district is the largest by asset value. San Francisco, followed by Kansas City and Minneapolis, represent the largest geographical districts. Missouri is the only state to have two Federal Reserve Banks (Kansas City and St. Louis). California, Missouri, Ohio, Pennsylvania, and Tennessee are the only states which have two Federal Reserve Bank branches seated within their states, with Missouri, Pennsylvania, and Tennessee having branches of two different districts within the same state. In the 12th District, the Seattle Branch serves Alaska, and the San Francisco Bank serves Hawaii. New York, Richmond, and San Francisco are the only banks that oversee non-U.S. state territories. The System serves commonwealths and territories as follows: the New York Bank serves the Commonwealth of Puerto Rico and the U.S. Virgin Islands; the San Francisco Bank serves American Samoa, Guam, and the Commonwealth of the Northern Mariana Islands. The Board of Governors last revised the branch boundaries of the System in February 1996.[4]

Assets

| Federal Reserve Bank | Total assets (09/15/2010)[5] |

|---|---|

| All banks | $2.299T |

| New York | $1.106T |

| Richmond | $257B |

| San Francisco | $224B |

| Atlanta | $162B |

| Chicago | $124B |

| Dallas | $88B |

| Philadelphia | $80B |

| Cleveland | $61B |

| Boston | $59B |

| Kansas City | $55B |

| St. Louis | $42B |

| Minneapolis | $41B |

See also

- Federal Reserve System

- Federal Reserve Act

- Federal Reserve Branches

- List of regions of the United States#Federal Reserve banks

References

- ^ Sullivan, arthur; Steven M. Sheffrin (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. p. 417. ISBN 0-13-063085-3. http://www.pearsonschool.com/index.cfm?locator=PSZ3R9&PMDbSiteId=2781&PMDbSolutionId=6724&PMDbCategoryId=&PMDbProgramId=12881&level=4.

- ^ "FRB: FAQs: Banking Information". Federalreserve.gov. 2006-02-12. http://www.federalreserve.gov/generalinfo/faq/faqbkinfo.htm. Retrieved 2010-07-08.

- ^ McDonough, William J. "An Independent Central Bank in a Democratic Country: The Federal Reserve Experience." University of Chicago, Chicago. 22 Apr. 1994.

- ^ a b "The Twelve Federal Reserve Districts". Federal Reserve. The Federal Reserve Board. December 13, 2005. http://www.federalreserve.gov/OTHERFRB.HTM. Retrieved 2009-02-18.

- ^ "Factors Affecting Reserve Balances/Release Dates/Current release". federalreserve.gov. http://www.federalreserve.gov/releases/h41/. Retrieved 2010-11-17.

Sources

- "The March of Events: The Federal Reserve Districts". The World's Work: A History of Our Time XLIV (1): 10–11. May 1914. http://books.google.com/?id=zegeQtMn9JsC&pg=PA10. Retrieved 2009-08-04. "The first new piece of machinery for the new currency system is now provided.".

External links

04.27.2011. 08:45